By Shawn Gibson CIO, Portfolio Manager & co-Founder of Liquid Strategies, LLC.

EXECUTIVE SUMMARY

• Behavioral finance has a significant impact on both the short-term and long-term pricing of options

• The flexibility to use options in creative ways has helped to consistently drive options volume higher as more market participants get more comfortable with their use

• Most rapid shifts in implied volatility are usually short-lived, as implied volatility tends to revert back to long-term averages

• Option investors would be wise to understand the nuances of how implied volatility impacts the price they buy or sell

In equity markets, stocks move up and down based on the perceived value of the company depending on various fundamental and technical factors. Options on stocks and equity indices not only move in response to the market’s perceived value of the underlying instrument, but they are also significantly impacted by the participant’s value of the options themselves. While options pricing models can guide investors to calculate a theoretical value, the actual value of the options are routinely heavily influenced by human behavior and emotions. The purpose of this paper is to help clarify some of the real-world impacts of behavioral finance on the options markets.

SHORT-TERM IMPACT OF INVESTOR BEHAVIOR ON OPTION PRICING

To understand how behavior can impact an option price, it is important to first understand the inputs that go into pricing an option. There are six main inputs that go into option pricing models that produce option theoretical values:

1) Stock/index price

2) Strike price of the option

3) Expiration date of the options

4) Dividends paid by the underlying

5) Risk-free interest rate

6) Implied volatility

The first three inputs lack any subjectivity as the stock/index price and expiration date are simply factual in nature and offer no room for arbitrage in the option prices. The next group of two, dividends and risk-free rates, have some level of subjectivity as market participants may have differing opinions on what dividends a company might pay in the future or how risk-free interest rates might change. However, changes in these inputs do not usually have significant impacts on pricing and leave little to no room for arbitrage. The final input, implied volatility, is highly subjective and is the lever used by market participants to adjust their perceived value of options. In simple terms, implied volatility is simply the estimate for volatility in the underlying instrument up to the expiration date. This estimate is based on a combination of historical volatility (the recent actual volatility of the underlying) and forecast volatility (adjust historical volatility for factors that might change that volatility higher or lower going forward).

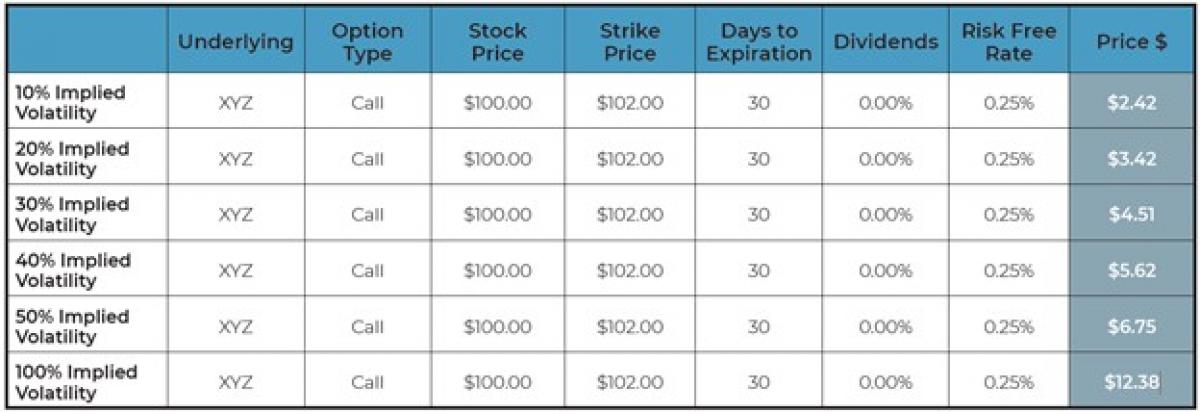

Implied volatility is a constantly changing input that adjusts based on shifts in the actual volatility of the stock, a change in the outlook of future volatility, and supply and demand from participants. Changes in supply and demand are where behavior has the largest impact on implied volatility. In order to better visualize the impact that implied volatility has on an option price, below is a hypothetical look at how an option price moves via the implied volatility lever.

As the table below shows, the change in implied volatility alone has a significant impact on the option price, and therefore the required move in the underlying for the option to be profitable.

From a behavioral perspective, dramatic moves in implied volatility, and thus option prices, come from a foundation of fear and/or greed. In 20+ years of trading options, situations, where option buyers become mostly cost agnostic, are quite common, paying nearly any asking price for calls or puts in a volatile situation. Following are a couple of examples where option buyers can become price agnostic:

1) Deep Market Selloffs

Given the significant diversification of indices such as the S&P 500, it is far less common for implied volatility to make wild swings. The exception is in periods of extreme market stress where traders are trying to find the fastest way to reduce risk without dealing with liquidity in single stocks or giving up upside when the market recovers. These situations lead to extremely heavy put buying causing the demand for options to far exceed the supply. In turn, implied volatility is rapidly adjusted to better compensate sellers for the risk they take on. The most recent example of this is the COVID-19 selloff. The implied volatility of the options on the S&P 500 (expressed through the CBOE S&P 500 Volatility Index – “VIX”), went from a low of 14.49 on 2/20/20 to a high of 49.48 on 2/28/20 before peaking at 85.47 on 3/18/20. This is a classic behavioral example of investor fear and panic shocking option prices.

2) Single Stock News/Rumors

Individual companies make big “surprise” moves every day based on either a major news event, rumors, or in most recent times, coordinated buying of stocks through message boards. Whether it is a takeover rumor, an accounting scandal, meme stocks, or other issues, investor behavior can impact option pricing based on both fear and greed. On the greed side, traders are looking for a quick, defined risk way to capitalize on a situation and start aggressively buying what they think are cheap calls or puts, driving up implied volatility to potentially extreme levels. This creates a heavy demand imbalance while market makers and other participants that are short these options start to lose money in two ways: 1) their existing positions that closed at much lower implied volatility now must get marked up, threatening the potential for margin calls; and 2) these option sellers get more short the stock as it goes up or more long it as it goes down, so they need to aggressively hedge themselves either through the stock itself or oftentimes through buying options themselves. The fear of potentially being wiped out due to margin calls is a major incentive for option sellers to raise implied volatility so that they can either buy some themselves or at least sell more at much higher prices. A good example of a meme situation was Wendy’s (WEN). WEN went from a low of $22.84 on 6/7/21 to a high of $29.46 the next day as Reddit message board members touted the stock. At the close on 6/7/21, a call option that was about 9% above the share price with about 5 weeks left until expiration closed at $0.25. A comparable option closed at $4.30, a 16x increase caused solely by the explosion of implied volatility in WEN.

LONG-TERM IMPACT OF INVESTOR BEHAVIOR ON OPTION PRICING

Most rapid shifts in implied volatility are usually short-lived, as implied volatility tends to revert back to long-term averages at some point. However, due to the risk of major volatility shifts happening at any time for any reason, sellers typically demand to get paid a premium for taking that risk. This premium is referred to as the Volatility Risk Premium (VRP), which is calculated by the implied volatility of an option minus the actual volatility of the underlying up to the expiration date of that option. If this VRP did not exist, option sellers would disappear from the market until such time that the demand from buyers of those options go up to levels where sellers once again see a positive VRP. Persistent fear and greed by investors have resulted in there being a positive VRP the vast majority of the time, particularly in index options which carry much less single stock risk. The most common way to see this VRP in the broad market is by looking at the VRP in the S&P 500 Index. This can very easily be extracted by comparing the VIX, which measures S&P 500 Index implied volatility about 30 days out, on a specific day to the actual S&P 500 volatility during the subsequent 30 days. As the data points dating back to 1990 illustrate, the VRP on S&P 500 Index options has been persistent and meaningful.

- The average VRP was 4.03. Based on an average VIX of about 19.53, this means the long-term average realized volatility was only 15.50, resulting in an average 26% VRP in these options.

- Every year, including 2020, had a positive average VRP during the year with the exception of 2008 (30 of the 31 years).

- Nearly 93% of all quarters had a positive VRP.

- Out of 7,935 rolling 30-day measurements, over 86% were positive, demonstrating consistency both on a long-term and short-term basis.

SUMMARY

Behavioral finance has a significant impact on both the short-term and long-term pricing of options and manifests itself both in fear and greed. This creates daily opportunities for option traders to either buy options that they think have implied volatilities that are too low based on a situation or for sellers of options that step in when options reach extreme levels of implied volatility that may not be sustainable (thus offering the potential for a significant VRP). The flexibility to use options in creative ways has helped to consistently drive options volume higher as more market participants get more comfortable with their use. Option investors would be wise to understand the nuances of how implied volatility impacts the price they buy or sell, or else risk has a very disappointing, and potentially expensive experience.

About The Author:

Shawn Gibson CIO, Portfolio Manager Shawn co-founded Liquid Strategies in 2013 and serves as CIO and Portfolio Manager. Shawn brings more than 25 years of investment experience primarily in the area of options trading and options portfolio management.

Shawn started trading options in 1997 with the Timber Hill Group, where he was an options market maker on the floor of the Pacific Exchange and later promoted to join a small team in Greenwich, CT responsible for overseeing the firm’s multi-billion dollar options trading portfolio. He subsequently served as Head of Options Strategy and Director of Alternative Investments at BB&T, where he worked with advisors and their clients to develop options-based hedging and yield-enhancing strategies. Shawn is an active member of his community and was voted as one of the Top 40 leaders under 40 while living in Richmond after being nominated by his peers due to his professional accomplishments and community involvement. Shawn earned his B.S. in Commerce from the University of Virginia.

Disclaimer: The assertions and statements in this white paper are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision-making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss. Options involve risk and are not suitable for all investors. Please see the following options disclosure document (ODD) for more information on the characteristics and risks of exchange-traded options. http://www.optionsclearing.com/publications/risks/riskstoc.pdf