By Allen Sukholitsky, CFA, Chief Investment Officer at Masterworks.

Allocating to art has frequently benefited portfolios, historically

Among geopolitical tensions, decades-high inflation, a new rate hike cycle, and the potential for a recession to rear its ugly head, it may be as good a time as any to rethink portfolios allocated only to equities, fixed income, and/or traditional alternative investments. Specifically, we find that several different hypothetical portfolios - from a 60/40 to an endowment-like approach - have improved frequently, by adding an allocation to art. As it turns out, a little art may go a long way.

Art has frequently improved portfolios because of its correlation profile

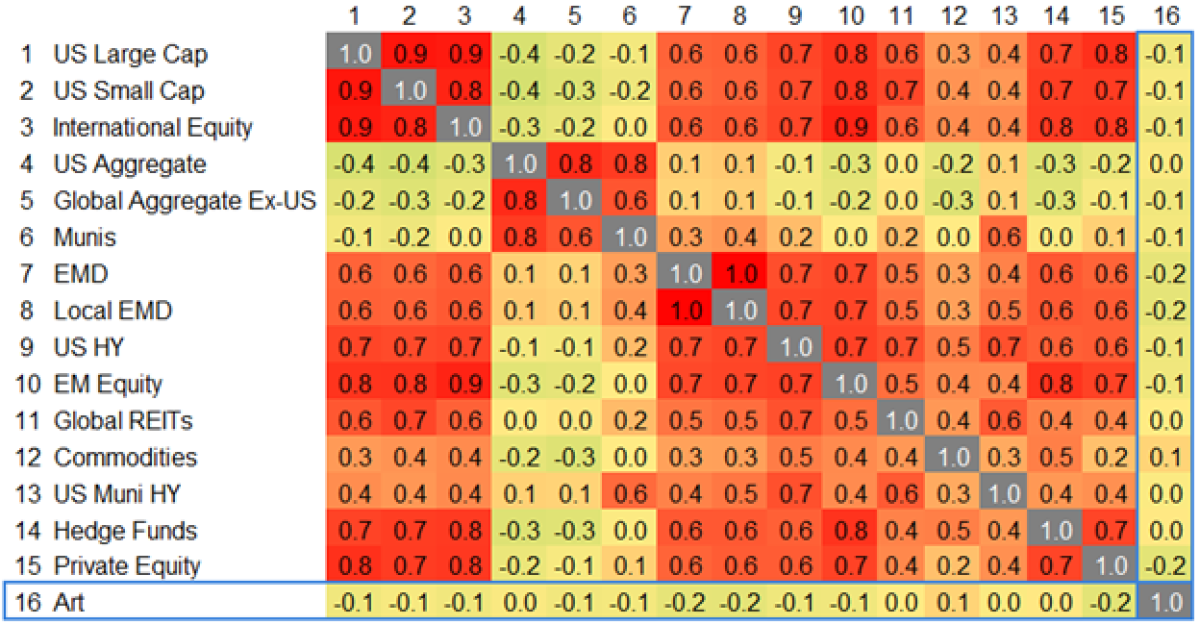

Art has exhibited little to no correlation with any other major asset class from 1997 through H1 2021, making it a potentially attractive diversifier*. In fact, consistently low correlation across major asset classes appears to be a characteristic unique to art. In Figure 1, we see that the correlations in row/column 16 are close to zero across the board, potentially implying that art may help to diversify a portfolio no matter what might already be in it.

In contrast, each of the other asset classes has proven to be a mixed bag in terms of its correlation benefits - having low correlations to some asset classes, but higher correlations to other asset classes. For example, private equity has low correlations to bonds, but higher correlations to public equities. Or commodities, which have lower correlations to bonds, but higher correlations to hedge funds. None of the aforementioned is intended to imply that some asset classes have no place in a portfolio. Rather, while there are no guarantees, we believe it is important for investors to understand the magnitude of the diversification benefits* that they might experience by including different asset classes. Because of art’s correlation profile, we would argue that its benefits are significant.

*Diversification cannot ensure a profit or protect against loss in a declining market. It is a strategy used to help mitigate risk.

Figure 1: Contemporary Art has had little to no correlation with other assets

For illustrative purposes only. Source: Bloomberg, Masterworks. Correlations calculated from 12/31/1997 to 6/30/2021, based on: US Large (S&P 500), US Small (Russell 2000), Int’l Equity (MSCI EAFE), US Agg. (Bloomberg US Aggregate), Glbl Agg. xUS (Bloomberg Global Aggregate ex-US), Munis (Bloomberg Municipal), EMD (JPM EMBI Global), Local EMD (JPM GBI EM Global), US HY (Bloomberg US HY), EM Equity (MSCI EM), Global REITs (FTSE NAREIT Composite), Commodities (S&P GSCI), HY Muni (Bloomberg Muni HY 2% Issuer Cap), Hedge Funds (HFRI FoF Diversified), Private Equity (Refinitiv Private Equity), and Art (Masterworks Contemporary Art).

Frequent outperformance reduces the need for timing allocations

We believe that a portfolio’s frequency of outperformance from allocating to a new asset class is among the most important considerations when deciding whether to allocate to that new asset class. If a new allocation to an asset class frequently improves a portfolio’s performance, then the question of when to allocate to that new asset class becomes less relevant.

Let’s take an example. A portfolio has two asset classes in it, asset class “X” and asset class “Y”. An investor is considering adding asset class “Z”. If the portfolio with asset class “Z” has outperformed the portfolio without “Z” most of the time, then it matters significantly less when the investor decides to allocate to asset class “Z”. After all, the outperformance happens frequently.

In fact, the frequency of outperformance may also be more important than the magnitude of outperformance. Let’s stick with the example in the prior paragraph. If the portfolio with asset class “Z” in it only outperforms a small percentage of the time - but by a significant amount during that small percentage of the time - then the investor would only benefit from that sizable gain by allocating specifically during the times when asset class “Z” outperforms. Since that outperformance does not happen frequently, it may be challenging to invest at precisely the times when the outperformance will take place. We believe investors would prefer to benefit from time in the market more so than timing the market.

In the next three sections, we look at three hypothetical portfolios: 60/40, diversified, and endowment-like. We show that by adding a small allocation to art, a portfolio has frequently outperformed its baseline (i.e. without art) counterpart.

A traditional 60/40 portfolio has benefited from a small art allocation

Despite having a basic asset allocation strategy (Figure 2), the baseline 60/40 portfolio has performed well, historically, on the back of both a bull market in equities and a bull market in fixed income. We chose to fund the small allocation to art out of equities rather than fixed income because the former is a return-generating asset class, while the latter is a risk-managing asset class. Prudence would therefore suggest funding art - a non-traditional alternative investment - out of equities.

Source: Bloomberg, Masterworks. The above is a hypothetical illustration of mathematical principles, based on a sample scenario and is in no way meant to predict or project the performance of an investment or investment strategy. S&P 500 (S&P 500), BBg US Agg. (Bloomberg US Aggregate), and Art (Masterworks Contemporary Art).

Nevertheless, the portfolio with a small allocation to art frequently improved upon its baseline 60/40 counterpart (Figure 3). For example, in 100% of 10-year periods, the portfolio with art had a higher Sharpe ratio than the portfolio without art.

A “well-diversified” portfolio has benefited from a small art allocation

As a result of strong US equity performance vs. international markets, the more diversified portfolio (Figure 4) has proven to be less than ideal from a performance standpoint, for more than a decade. However, we chose to explore whether this portfolio would benefit from an allocation to art because, as the quip goes, “diversification works over time, not every time.”

The results for making a small allocation to art were even better (Figure 5) than in the prior example, again, driven by a “lower outperformance hurdle” due to international markets’ lagging US markets. For example, in 100% of five-year and ten-year periods, the portfolio with art experienced higher returns than the portfolio without art.

An “endowment-like” portfolio has benefited from a small art allocation

The endowment-like portfolio (Figure 6) owes a lot of its success to its harvesting of the illiquidity premium found in private markets, such as private equity, real estate, and infrastructure. Not surprisingly this has often made it challenging to improve upon. Here, we funded the small allocation to art out of equities 1) for similar reasons outlined in the 60/40 portfolio section and 2) because it is not always easy to reallocate from illiquid asset classes.

The endowment-like portfolio with art demonstrated frequent improvement over its non-art counterpart (Figure 7), albeit less frequently than in the prior two portfolio examples. Here, the portfolio with art had a higher Sharpe ratio in only 71% of five-year periods and lower volatility in only 54% of five-year periods.

Art deserves to be part of an investor’s asset allocation framework, in our view

We think the results of the three portfolios’ reallocations to art are compelling. In nearly 100% of all 10 year periods across various portfolio strategies, an allocation to art has improved its respective Sharpe ratio, increased its appreciation, and/or lowered its volatility. Additionally, art’s near-zero correlation to many other asset classes makes it a strong diversifier to include in many different portfolios. A little art may go a long way.

About the Author:

Allen Sukholitsky, CFA is the Chief Investment Officer at Masterworks. Masterworks offers institutional investors, wealth managers, and self-directed investors access to art as an investable asset class. To date, the firm has securitized 120+ paintings totaling $500M+ and anticipates buying ~$800M in art in 2022. By combining art market research with the securitization of the asset class, Masterworks aims to serve as a resource and market leader in the growth of art investing. Prior to Masterworks, Allen was a Senior Market Strategist at Goldman Sachs, focused on investment strategy, portfolio construction, and investment implementation. He was also previously an Investment Counselor at Citi Private Bank, working with UHNW clients on asset allocation and manager selection.

Important Disclosure Information

THE DATA INCLUDED HEREIN REFLECTS CHARACTERISTICS OF THE MARKET FOR PHYSICAL ARTWORK AND NOT FOR INVESTMENT SECURITIES

This document is confidential and is for informational purposes only. It should not be construed as investment advice or an offer to sell or buy any interest in any securities product, investment or instrument, which offer may only be made by means of a confidential private placement memorandum or other similar documents containing a description of the material terms thereof. You are strongly encouraged to read the confidential private placement memorandum before making a decision to invest. This information is provided for the benefit of certain sophisticated institutional and select individual accredited investors and is intended only for the person to whom it is given and is not to be reproduced or redistributed in any manner whatsoever. Any investment is subject to execution and delivery of the relevant subscription materials and the approval of Masterworks.

The investment opportunities described in this document are speculative, involve a significant degree of risk, and are not suitable for all investors. Only “accredited investors” are eligible to invest and we are required to take steps to verify accredited investor status.

An investor could lose all or a substantial amount of his, her or its investment. Any investment of a type described in this document may be highly illiquid and may be subject to restrictions on transfer. There may be no secondary market for the investment interest and none is expected to develop. The relevant investment may involve complex or specialized tax structures. Such investments are suitable only for sophisticated investors and require the financial ability and willingness to accept the significant risks inherent in such an investment for an indefinite period of time. Investors should consult their own finance, legal, accounting and tax advisor prior to making any investment.

This document contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain and actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. You are cautioned not to place undue reliance on any of these forward-looking statements.

Materials may include composite returns of similar works selected by Masterworks based on public auction sales data. The data is used for comparative modeling purposes only. Each painting is unique and historical performance of the similar works is not a direct proxy for performance of the specific painting or the shares. There is no current market for the shares and performance of the shares will reflect costs and fees described in our confidential private placement memorandum. Past performance may not be indicative of future performance.

In these materials we may present comparisons of Artwork to other asset classes, however any such comparison is of limited value due to the fact that there are significant differences between these asset classes. Artwork is held exclusively for capital appreciation, similar to Gold and most private equity investments. By contrast, U.S. T-Bills and U.S. Government Bonds are held primarily for current yield, though their value changes with changes in prevailing market interest rates. The S&P 500, which represents a collection of stocks, Hedge Funds and Real Estate are typically held for a combination of current dividend yield and capital appreciation. Oil is a commodity that is traded by speculators and end users. Stocks, U.S. Government Bonds, U.S. T Bills, Oil and Gold are highly liquid and valuation is driven by price discovery through continuous trading among large and diverse pools of capital. Artwork, Real Estate, investments in Hedge Funds and Private Equity, all represent unique opportunities and are typically relatively illiquid. These types of investments are therefore more difficult to value and price than assets that trade regularly. In addition, the costs of art ownership and buying and selling artwork may differ materially from ownership and transactional costs associated with investing in the other asset categories presented in the table.

Masterworks is not registered, licensed, or supervised as a broker dealer or investment adviser by the SEC, the Financial Industry Regulatory Authority (FINRA), or any other financial regulatory authority or licensed to provide any financial advice or services. Certain equity owners of Masterworks operate in their capacity as a “principal” to Masterworks platform transactions pursuant to SEC Rule 3a4-1.

The value of investments may go down as well as up.

Past performance is not indicative of future results.

.