By Rush Harvey, CMT, CAIA, Director of Private Capital Advisory at Raymond James.

I left the limited partner (“LP”) seat in April 2022 to join the Private Capital Advisory (“PCA”) team at Raymond James (“RJ”) and have received the questions below weekly since from both LPs and General Partners (“GPs”):

Why’d you do it? How is the dark side? Are you crazy? Do you miss it?

The timing of my exit, nearly two years ago, to join the placement agent business was fortuitous, coinciding with the average LP's ability to deploy capital coming to a screeching halt.

Indeed, poor public market performance and the lack of distributions from private market GPs were becoming too much to bear to maintain capital deployment at the previous pace for the average LP.

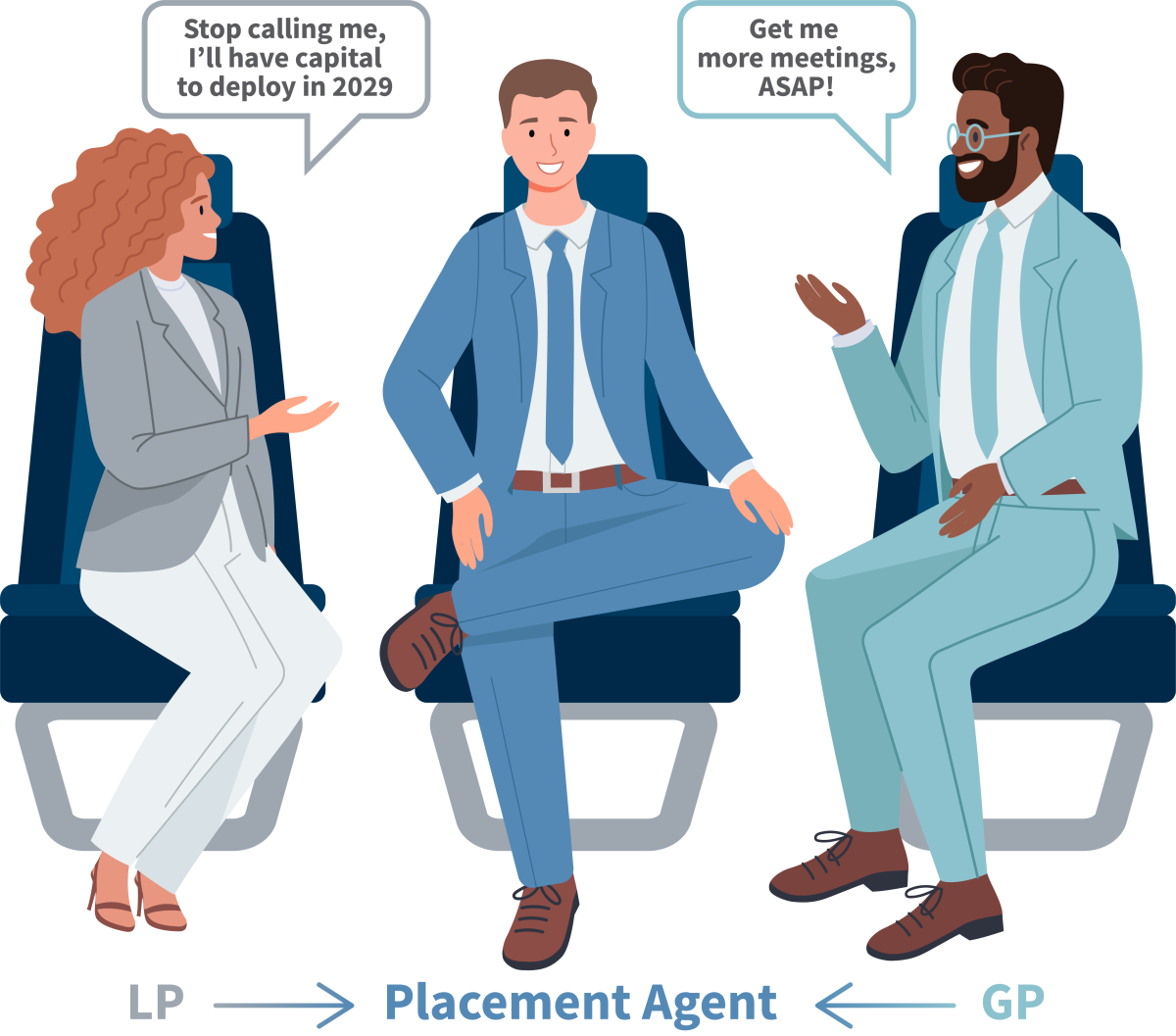

A perfect storm in my professional life led me to ask myself the same questions! Thankfully, the answers are somewhat easy to share as I reflect on this part of my journey from being an LP to sitting “in the middle seat” working to be an advocate for LPs and GPs.

My job is now to be a source of relevant deal flow for LPs and to support GPs as they work to execute their investment process. Every day, my goal is to be a great partner and connector in the market regardless of revenue, which is crazy.

What does that mean? For example, if an LP wants deal flow in asset classes where we don’t have mandates, I still make introductions. Even if a GP isn’t a client, I will try to arrange meetings for them if what they do could interest an LP. This is simply the “right thing to do”. I want our ability to be a friend and resource in the market to LPs and GPs alike to be our “superpower” at RJ PCA. My perspective, transitioning from an “old LP” to a placement agent has surprisingly been needed to help both LPs and GPs make sense of the current environment. I am enjoying the view from the middle seat because I can be more helpful than ever before.

Look, I understand as well as anyone that the role of an LP is perceived as glamorous in every aspect. You're the one writing the checks, making everyone (myself included) eager to connect with you. However, I'm also aware of the hard work involved, the numerous constituents you need to manage, and the fact that performance is the ultimate reflection of how effectively you spend your time. While being an LP is certainly awesome, becoming a great LP requires time and hinges on your ability to cultivate, maintain, and at times, part ways with relationships.

My favorite part of the LP job was the relationships. It was always a highlight to call a GP and say, 'Hey, we are in for Fund II, let's go!' Declining opportunities was never fun, and those conversations, particularly about re-ups, were always challenging. But doing business the right way, which I define as being transparent, direct, and kind requires practice (lots of reps).

This is the reason why I have been able to “shift” to connecting GPs and LPs in my new role during one of the toughest fundraising markets we have seen in many years.

The data backs this up, but you don't need to look far—any conversation with a fundraising professional might soon have you reaching for a strong drink, no matter the time of day. It's challenging out here. My colleagues at RJ PCA recently published a report on Bloomberg illustrating just how challenging it is. (shameless plug).

Enough with the negativity!

What is extremely compelling for GPs and LPs alike is that allocations to private markets, especially Private Equity, are increasing over the long term. This is true whether you talk to public pensions, endowments, family offices, or wealth management platforms. The need to generate nominal returns that can sniff double digits, accounting for inflation, of course, is only increasing. Most folks, especially consultants that run sophisticated asset allocation studies for LPs, believe increasing private capital and making it a larger part of a diversified portfolio is not a “nice to have” going forward, but a “must have”.

Rather than being on the “dark side,” I feel more like a member of the Jedi Council striving to make “our world” a better place. GPs need support to diversify their LP base and craft their story to stand out in a very competitive market. I am happy to help.

LPs are inundated with “deals” and need support to find “partners” who genuinely care about what they do and who they support. I am happy to help.

Adapting to the middle seat, although it took me time to get used to, has forced me to be comfortable being uncomfortable. This has been a blessing, as it's hard for growth to happen at any level hanging out in your comfort zone.

It’s ultimately up to the LP and GP to “make the magic happen” and build a long-term partnership. The best placement agents embrace their ability to be helpful and add value during the due diligence process. Sometimes making an introduction and getting out of the way is enough. You must be able to get in the weeds when needed as well, sometimes very thick, and nasty weeds. It’s the job and being able to be supportive, via whatever that means to LPs and GPs, is what really matters.

I do miss sitting in the proverbial window seat in first class as an LP and sometimes envy GPs who have a great aisle seat next to the bathroom. We are all trying to get to the same destination and my new role has given me perspective to appreciate just being on the plane!

I am happy to sit in the middle seat and do what it takes to add value. If that means making a lot of coffees and cocktails along the way, just let me know how you’d like your drink prepared!

About the Author:

Rush Harvey, CAIA, CMT, is a Director on the Private Capital Advisory (“PCA”) team at Raymond James (“RJ”), which provides placement, secondary, and advisory services to both General Partners (“GPs”) and Limited Partners (“LPs”). RJ PCA combines a broad scope of global capabilities and expertise with a commitment to delivering results for both LPs and GPs. RJ PCA is supported by the strength of RJ’s full-service investment banking platform, which provides GPs and LPs access to differentiated industry expertise, research, and capabilities.

Prior to joining RJ, Mr. Harvey worked at the Texas A&M University Foundation as Director of Investments. Mr. Harvey was a member of an investment team that managed roughly $3.0 billion of endowed assets on behalf of Texas A&M University and various related institutions. Mr. Harvey was responsible for sourcing, diligence, hiring/firing recommendations, and monitoring of current and prospective public and private managers across all global asset classes. Prior to joining the Texas A&M University Foundation, Mr. Harvey held the same role at the Kansas State University Foundation in Manhattan, KS. Prior to joining the KSU Foundation, Mr. Harvey was Research Project Manager at Envestnet | Prima in Denver, CO. In this role, Mr. Harvey managed the workload and day-to-day responsibilities of an 11 member investment research team which was responsible for the selection and monitoring of investment managers across all public global asset classes. Prior to joining Envestnet | Prima, Mr. Harvey served as a Research Analyst for MQ Capital in Dallas, TX. Mr. Harvey is a Chartered Market Technician and Chartered Alternative Investment Analyst. Mr. Harvey graduated from Oklahoma State University with a Bachelor of Science Degree in Finance and also obtained a Master’s of Science Degree in Security Analysis and Portfolio Management from Creighton University. Mr. Harvey currently serves on the Advisory Committee for the Masters of Science in Finance program at Texas A&M University. Mr. Harvey is a frequent guest lecturer at the Mays School of Business at Texas A&M University.