PricewaterhouseCoopers, in a new report, predicts that the next 5 years will be transformative for the alternative investment industry, given technological change, the growth in assets under management, the changing nature of the investor base behind those AuM numbers, and increasingly intense public attention. It has prepared a new report designed to help managers through these years.

PricewaterhouseCoopers, in a new report, predicts that the next 5 years will be transformative for the alternative investment industry, given technological change, the growth in assets under management, the changing nature of the investor base behind those AuM numbers, and increasingly intense public attention. It has prepared a new report designed to help managers through these years.

The report, “Alternative asset management 2020: Fast forward to center stage,” says among much else that data and the pipes through which it travels will lose their centrality in the years to come. By 2020 “the pipes have been laid and the leading firms will be focused on the analysis of data and data-informed decision making” rather than data accumulation.

After the Pipes

The laying of that pipe over the next half decade will entail “data standard protocols allowing all parts of [an asset management] organization to exchange information, creating a self-service model.” The same protocol will let the organization as a unit exchange data as needed with its counterparties and service providers. This will all become as natural as “turning on a tap.”

The report describes a “day in the life” of a typical compliance analyst in 2015 and again in 2020. This person now gathers information, wades through “false positives,” and “responds to the latest fire drill.” In the near future, he will “start each day reviewing key risk and compliance metrics presented in dashboard format,” and then drill down into indicators that are out of the ordinary.

One of the metrics displayed on the dashboard, for example, will be a performance contribution analysis, which will helpfully highlight for our compliance officer when a particular period’s performance is due overly much to a specific position in., say, XYZ Corp. Drilling down, the compliance officer might want to know which analysts cover XYZ, and which traders have bought or sold either for their personal accounts or for the firm or both.

Likewise with cybersecurity: firms with the pipes all in place will possess “robust defenses against cyber attackers who may increasingly target alternative asset managers.”

Pensions and Sovereigns

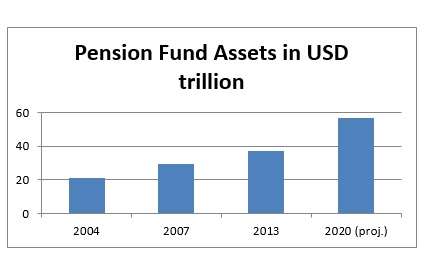

As to the movement to “center stage,” which gives the study its subtitle, the report explains for example that pension fund assets under management are growing at a rapid pace and are likely to reach $56.6 trillion by 2020.

Adapted from Fig. 3, PwC report, p. 11.

This is important because, PwC predicts, the needs of pension fund managers, and their growing interest in alternative strategies to satisfy those needs, are and will remain critical to the ongoing transformation of the alternatives business. The largest pension fund in the world is the Government Pension Investment Fund in Japan. In April of this year, the GPIF announced a new strategic asset mix allowing it to allocate 5% of its investment to alternatives. This is 5% of $1.1 trillion.

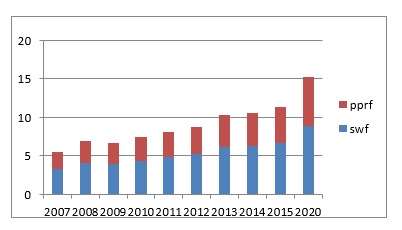

Likewise for the needs of sovereign wealth funds: they will also grow and become an ever more significant part of the investor base for the alternatives industry. PwC predicts the emergence of 21 new sovereign investors over the next 5 years, especially from the emerging economies of South America, Asia, Africa, and the Middle East.

Sovereign investors’ assets invested in the alternatives industry, along with the assets of public pension reserve funds, break down over recent years as follows (in US dollars, trillions, and along with a projection for 2020 based on the trend.)

Source: Adapted from Fig. 4, PwC report, p. 14.

An important fact about sovereigns: they are difficult to please, and they are too large to brush off. As PwC put it, where “they interact with alternative firms, sovereign investors are consolidating relationships and seeking more innovative ways to align both parties’ economic interests.”

SWFs tend to favor infrastructure and private-equity investments. Alternatives in general will constitute 29% of their portfolio by 2020 and 79% of that will be in those two areas: infrastructure and PE.