By Andrew Beer

By Andrew Beer

A recent article discussed a potential solution to excessive hedge fund fees, the Investor Aggregation Model, but highlighted near term obstacles, including industry structure and agency issues. This note discusses a more realistic alternative: a Core-Satellite Model that builds on the experience of the traditional asset management industry and recent developments in delivering hedge fund returns at low cost and with liquidity.

Twenty years ago, an institutional investor might have allocated to a dozen different mutual funds in order to get exposure to US equities. Each fund would charge relatively high fees and the underlying portfolios would likely have substantial overlap. Today, the same investor is much more likely to get core equity exposure through a low cost index fund, and to use more expensive active managers who have expertise in specific segments of the market. The low cost, index “core” helps to meaningfully reduce overall fees, and the value-added “satellites” can improve returns over time.

A similar transition will occur in the hedge fund space over the coming years. The historic obstacle has been a dearth of attractive, low cost “core” alternatives to investing directly in hedge funds. Investable indices – essentially super-diversified funds of funds – suffered from adverse selection bias and, while offering better liquidity, did little to address the cost of investing. Early hedge fund replication products successfully outperformed many actual hedge fund portfolios, yet adoption was hindered by product complexity and mediocre index/target performance. Today, there is a much more compelling suite of liquid investment alternatives – ranging from advanced factor models to risk premia strategies – that have been shown to deliver comparable returns to many hedge fund strategies.

As discussed below, the core-satellite model in the hedge fund space will differ from the traditional approach. Rather than a single “core” like the S&P 500, hedge fund core exposures will likely be broken down into a combination of portfolio level and strategy specific complements. Further, a well-constructed hedge fund core will not only lower all-in costs, but can improve liquidity, transparency and risk management – lacking in direct hedge fund portfolios. These additional benefits should factor into how the allocator “values” the core position.

Defining the “Hedge Fund Core”

You’ll find little resistance to the notion that a US large capitalization manager should be benchmarked to, say, the S&P 500. But what about a hedge fund? Allocators might compare a direct hedge fund portfolio to, say, the HFRI Fund of Funds index. However, unlike the S&P 500, the HFRIFOF is neither investable, liquid nor low cost. Consequently, its utility is for peer group analysis only – like comparing a mutual fund to six hundred of its peers.

So, how should investors approach this with hedge funds? Importantly, hedge fund portfolios often have different target returns: a typical multi-manager portfolio will have much more consistent (and positive) equity exposure than one constructed to have a beta around zero. Second, the liquidity of the underlying strategies matters: certain strategies – e.g. equity long/short or CTAs – are more “replicable” than others – e.g. illiquid relative value strategies.

Consequently, one investor’s “core” will differ from another. This argues for customized solutions rather than a one-size-fits-all approach. Well-designed factor-based replication models are very effective at delivering returns comparable to diversified hedge fund portfolios, while individual factor- and risk premia-based strategies can match or exceed the performance of discrete strategies. The two approaches are discussed below.

Portfolio Core Allocations

Portfolio core strategies are built on the idea that most hedge fund returns are generated by dynamic exposures to major asset classes. At a basic level, a hedge fund portfolio with a beta of 0.4 is strongly influenced by the performance of equity markets. Yes, security selection can add value, but it matters a lot more if equities as a whole are up or down 20%.

The key is that hedge fund exposures are spread across asset classes, and these exposures change over time. Hedge funds were overweight emerging markets pre-crisis – and benefited when the MSCI Emerging Markets index outperformed the S&P 500 by 121% over 2005-07 – but were underweight in 2012-14 when the S&P 500 outperformed by 61%. These macro bets, or tactical alpha, drive most hedge fund outperformance over time.

To address this, numerous firms (including ours) have used factor-based models to dissect how hedge funds are positioned across major asset classes. Live performance has demonstrated that the strategies can deliver comparable or better performance than many hedge fund portfolios. Importantly, since the strategies invest only in liquid instruments – ranging from ETFs to futures to liquid swaps – the portfolios themselves are liquid – hence, there’s no gating or illiquidity risk. Further, management fees should be 1% per annum or less, so implementation costs are a fraction of investing in hedge funds.

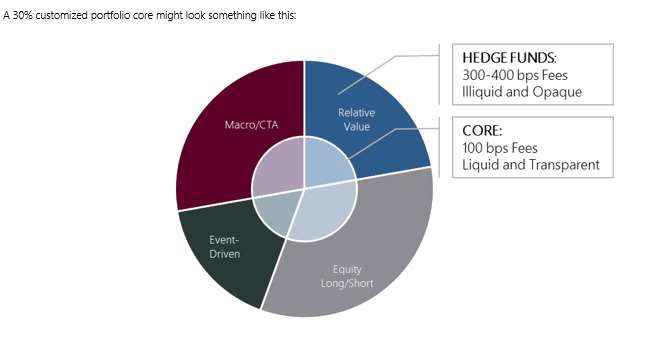

Given the current sensitivity to fees, the portfolio core approach provides the most “bang for the buck.” A 30% core allocation can reduce all-in fees by 100 bps or more while meaningfully improving liquidity, risk management and other criteria, as discussed below.

Strategy-Specific Core Allocations

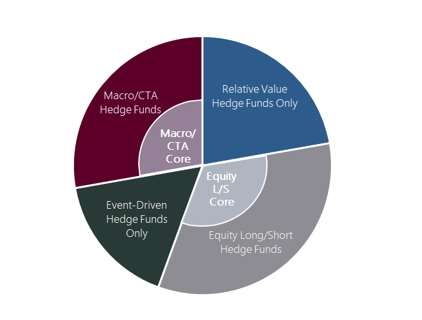

By contrast, strategy-specific core will seek to deliver comparable performance to a specific strategy. This approach treats the portfolio as a combination of definable investment strategies and seeks to introduce less costly, more liquid alternatives to one or more of them. Strategy-specific models range from factor-based strategies to alternative risk premia to 13F clones. An example with an equity long/short and CTA core is shown below:

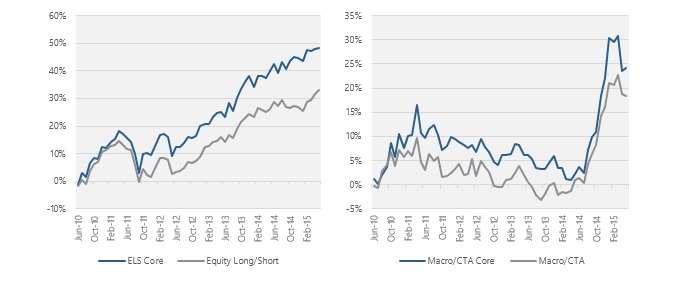

The underlying strategy will dictate which approach is most effective. For instance, equity long/short strategies tend to have relatively stable exposures to various segments of the equity markets – US large and small capitalization, international equities, emerging markets, etc. – hence, a well-designed factor model that seeks to capture 80-90% of pre-fee returns can deliver comparable or better performance over time. By contrast, CTAs shift exposures much more frequently and consistently rely on certain investment strategies, such as trend following; as a result, a well-designed core requires daily data or must employ specific strategies, such as simple trend following models. In each case, fee reduction can lead to better performance over time. Two examples are shown below:[*]

One important advantage of this approach is the ability to benchmark individual managers. If an equity long/short manager consistently fails to outperform a low cost, liquid ELS core, there is a clear and direct measure of value add, or lack thereof.

Defining the Benefits

Unlike traditional investments, hedge fund portfolios are more difficult to manage due to illiquidity, opacity, and other issues. A core-satellite approach helps to address many of these issues:

- Enhance long-term performance. The fee difference between hedge funds and replication based strategies can be 300 bps or more per annum; as long as the replication based strategies can deliver the majority of the pre-fee returns of the underlying portfolio or strategy, long-term performance will improve.

- Improve liquidity profile. Greater liquidity has three important benefits. First, it improves risk management and provides access to liquidity in extreme market circumstances – gating and suspensions, like 2008-09, should never be an issue. Second, it improves the ability to tactically allocate to strategies as opportunities arise – you don’t have to wait two quarters to allocate. Third, allocators can manage exposures more accurately – e.g. manage a glide path or maintain a target allocation by “toggling” exposures up and down at rebalancing dates.

- Maintain exposure to existing funds. Hedge funds can provide valuable information to allocators on market opportunities. Allocators can maintain exposure to existing managers and hence preserve the information flow.

- Concentrate due diligence resources. Allocators can concentrate on due diligence and monitoring resources on more idiosyncratic managers.

- Expand exposure to illiquidity premium. Many allocators feel pressure to maintain exposure to managers, like equity long/short and macro/CTA, where the underlying portfolios are more liquid, and hence less likely to deliver excess returns over time. An improved liquidity profile in a core allocation alleviates this pressure.

- More effective benchmarking. The performance of core strategies can shed light on which managers are truly delivering alpha.

Conclusion

The good news is that most consulting firms and institutional allocators are actively exploring lower cost and more liquid complements to investing directly in hedge funds. For broader adoption, however, the allocator community will have to overcome two issues going forward.

First, there is concern that the core will systematically underperform hedge funds. Two arguments in favor of hedge funds are security selection and the illiquidity premium. On the former, 400 bps of fees is tough to overcome over time, especially when shorting no longer delivers, on average, any alpha. On the latter, many strategies (such the equity long/short and CTA, as shown above) have very little exposure to illiquid assets.

Second, it requires a paradigm shift among allocators. As one fund of funds CEO recently noted, allocators must become more like investors to justify their fees. Investors should value enhanced flexibility – the ability to cut risk when necessary, tactically allocate to more attractive strategies as the opportunity set evolves. The model also provides a much cleaner way to evaluate whether managers are adding value over time.

The key for allocators is to start to view “fees” as a scarce resource. When fees are simply “above the line,” it is too easy to ignore the impact on performance. Pay a manager too much and you don’t get it back if he underperforms; instead, the status quo is simply to redeem and replace him with a better performer. By setting a fee budget, the allocator is forced to think about where fees are and are not justified. Paying 2/20 (or more) makes sense when the strategy is capacity constrained, less liquid and truly idiosyncratic. On the other hand, when the typical equity long/short manager or CTA is outperformed by a low cost strategy core, it forces allocators to seek out managers within the space who bring something special to the table.

[*] Hypothetical performance of a factor-based replication of the estimated gross returns of the HFRI Equity Hedge index and the Newedge CTA index over the past five years. Note that hypothetical results include estimated trading costs but are gross of fees.

Andrew Beer, CEO: At Beachhead, Mr. Beer oversees all marketing and research efforts and is influential in portfolio construction. Mr. Beer began his career in mergers & acquisitions at the James D. Wolfensohn Company, a boutique firm founded by the forthcoming President of the World Bank. Mr. Beer worked in leveraged buyouts at the Thomas H. Lee Company in Boston during his tenure at Harvard Business School. Upon graduating, he joined the Baupost Group, a leading hedge fund firm, as one of six investment professionals. Additionally, Mr. Beer co-founded Pinnacle Asset Management (leading commodity fund) and Apex Capital Management (Greater China hedge fund). Mr. Beer is an active member of the Board of Directors of the US Fund for UNICEF, where he serves as Chairman of the Bridge Fund, an innovative financing vehicle designed to accelerate the worldwide delivery of life-saving goods to children in need. With his wife, Mr. Beer is a co-founder of the Pierrepont School, a co-educational K-12 independent school located in Westport, CT. Mr. Beer received his Master in Business Administration degree as a Baker Scholar from Harvard Business School, and his Bachelor of Arts degree, magna cum laude, from Harvard College.