Investors are always in search of that ‘fail-safe’ investment option, the one that offers the perfect hedge against whatever risk du jour poses a threat. Even though conventional wisdom suggests there is no such animal, the quest continues, and periodically one category or another finds itself leading the charge in general interest. Currently at bat in this popularity contest is the category of hard assets, a broad swath of investment options that appear to offer some protection against the general inflationary and economic fragility fears at work in the markets today.

Yet most investors feel uncomfortable investing personally in specialty segments. With renewed interest in these ‘alternative alternatives,’ niche managers who can provide skilled access are creating funds that answer these specific needs. Investors can choose to own the hard assets themselves if they feel knowledgeable enough to do so, or participate through a comingled fund vehicle, or perhaps invest with a combination of both.

GROWTH EQUALS STRESS

Population growth and a burgeoning middle class worldwide have added increased pressure on the planet's natural resources. Foodstuffs to feed the global population, industrial materials to build infrastructure, and energy resources to meet electricity and transportation requirements all increase the pressure on today’s supply and demand balance. Combine this with the long-term detrimental impact of the global financial crisis, which at this point seems more like a global status quo, and investors have good reason to be wary of risk in many forms.

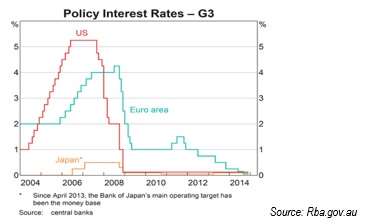

Inflation fears lead the way in investors’ minds as one of the major potential threats to many traditional investment holdings they own or might add to their portfolios. Zerohedge.com succinctly stated in its 2015 outlook: The narrative that the U.S. is tightening continues to be a false one – one heard for many years now. Any meaningful increase in U.S. interest rates would likely severely impact already stretched and stressed asset markets and plunge the U.S. and the world into a depression. As the following chart shows, the US has basically held rates at near-zero since 2008 and, although verbal indications from the Fed allude to stepping rates back up, actions speak louder than words.

Inflation fears lead the way in investors’ minds as one of the major potential threats to many traditional investment holdings they own or might add to their portfolios. Zerohedge.com succinctly stated in its 2015 outlook: The narrative that the U.S. is tightening continues to be a false one – one heard for many years now. Any meaningful increase in U.S. interest rates would likely severely impact already stretched and stressed asset markets and plunge the U.S. and the world into a depression. As the following chart shows, the US has basically held rates at near-zero since 2008 and, although verbal indications from the Fed allude to stepping rates back up, actions speak louder than words.

ANGST ASSETS: 5 OPTIONS TO CONSIDER ADDING TO YOUR PORTFOLIO

With uncertain global markets dictating a growing need for specialty or niche assets to provide some measure of diversification, ‘Doomsday’ prophets would recommend looking at the options available through hard assets. So what makes hard assets attractive? Beyond their non correlated valuation versus traditional assets, hard assets have the additional benefit of holding intrinsic value due to the limited nature of their supply. Investors fearful of widespread market downturns and volatility might find the specialty focus and rarefied universe of some hard assets an attractive component to add to their overall portfolio. These choices can be tailored to match personal interests as well as investment objectives.

The guns-n-gold crowd is likely to stockpile precious metals and antique guns. Homesteaders will look to farmland, food commodities, and other easily traded assets such as precious metals. And the more esoteric investors might look to the options offered through antique cars, fine wines, rare art, and stamps or coins. The following offers a brief introduction to several of the more popular categories of hard assets, courtesy of Commodity HQ (“Doomsday Special 7 Hard Asset Investments You Can Hold In Your Hand”).

PRECIOUS METALS (PARTICULARLY GOLD, SILVER, AND PLATINUM)

- Gold: Gold prices currently hover around $1,200/troy ounce. Owning gold bars, coins, and jewelry means that the value of the assets you can hold in your hand will move in unison with spot gold pricing. This inherent hedge against inflation allows investors to avoid the nuances of futures contracts as well as settling for indirect equity exposure through mining companies.

- Silver: The price of silver is impacted by a variety of factors which are closely tied to the economic cycle. Used in both commercial applications and well as for jewelry production means that its demand is broad-based but closely aligned with global market trends.

- Platinum: Used mainly as an industrial resource, platinum’s demand stems primarily from the automobile and electronics industries. The production of this metal is heavily concentrated in emerging nations, making platinum prone to frequent price spikes.

ANTIQUE GUNS: Purchases of guns, both commercial and collectible, have been steadily on the rise in recent years. Demand in the US has been fueled by growing fears of tightening gun-control laws. Any further indications of such regulatory restrictions would likely spark a drastic increase in the value of certain guns, as they are commodities with fairly fixed supply levels.

STAMPS: Similar to art, rare coins, fine wines, and other collectibles, stamps derive their worth from the investment community that deems them valuable for purchase and trade. Simply put, stamps are a non-productive, collectible asset, much like gold bars and silver coins, but with a more narrowly-defined universe of buyers and sellers.

FARMLAND: Rising populations in booming emerging markets across Asia and Latin America are driving food demand. With land in general a finite resource and farmland even more so, prices for producing acreage at home and abroad have appreciated greatly in response to the growth in agribusiness struggling to meet the needs of an expanding world population.

CLASSIC CARS: Classic cars, which include both antique models and selective later editions, are strikingly similar to collectible guns in their market; both are luxury goods which can also be used for personal enjoyment. This collectible category is more volatile in nature than gold and prone to wide fluctuations in popularity demand. However, certain segments of the classic car market can outperform many of the other hard asset segments, as prices move in reaction to collector sentiment and are severely constrained by limited supply.

MAKING A HARD CHOICE

Investing is part science, part sentiment, and part luck. You can be right. You can be wrong. More likely you will be both. Though predicting when each phase will occur is an exercise in futility, hard assets can help to mitigate the travel between these states.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 and specializing in a wide range of writing services within the alternative assets sector. She has over 20 years’ of expertise in hedge fund marketing, investor relations, sales collateral, and a variety of thought leadership deliverables. In 2015, Panegyric Marketing received AI’s awards for Best Financial Services Marketing & Communications Firm and Business Excellence in Strategy & Positioning Statements – USA, as well as M&A's Excellence in Financial Services Marketing – USA. The firm also won consecutive year awards in 2013-14 as IHFA’s Innovative Marketing Firm of the Year and AI’s Marketing Communications Firm of the Year- USA. A published author and speaker, Ms. Harrison’s work has appeared in many industry publications, both in print and on-line.

Contact: dharrison@panegyricmarketing.com or visit www.panegyricmarketing.com.