One venerable theory among alpha seekers is that one should bet on “vice,” that is, one ought to invest in companies that sell products widely regarded as anti-social, precisely because such companies are likely to have been heavily discounted.

One venerable theory among alpha seekers is that one should bet on “vice,” that is, one ought to invest in companies that sell products widely regarded as anti-social, precisely because such companies are likely to have been heavily discounted.

With all the regulatory and sociological artillery aimed over the years, over the decades now, at companies that sell liquor or tobacco, or allow gamblers to lose their money at felt tables, isn’t it plausible that investors have fled from the pertinent securities, and that the flight has more than compensated for the actual vulnerabilities? So runs the theory. It is an outgrowth of a hypothesis expounded by no less august a figure than Robert Merton.

Merton, in a 1987 publication, “A Simple Model of Capital Market Equilibrium with Incomplete Information,” spoke of “neglected stocks,” that is, of stocks with a small investor base and accordingly followed by few analysts. He explained that an equilibrium model might allow for the earning of higher returns by these neglected stocks.

An Empirical Test

A recent study in The Journal of Law and Financial Management, a publication of The University of Sydney (Australia), puts the bet-on-vice view to an empirical test.

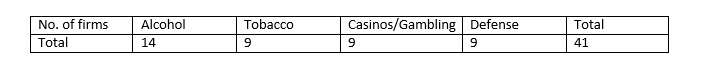

Greg Richey, a lecturer of finance at California State University, San Bernardino, seeks to determine in his own words “how the individual vice industries have performed against the market portfolio” in the period from October 2007 to October 2013.

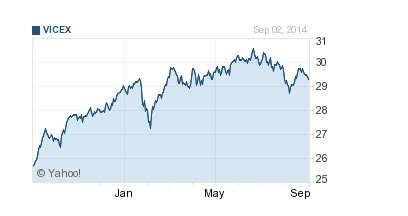

Richey could find no hedge funds, and only one mutual fund, that employs investing “in vice-related industries as a dominant strategy of investor focus.” That one mutual fund is Morningstar’s VICEX. But this may simply mean that the underlying stocks are still neglected, and that Merton’s reasoning, if it ever held, still holds.

The recent performance of VICEX is displayed above, with credit to Yahoo!Finance.

Failing the Test

But alas, the theory doesn’t pan out. Richey’s figures indicate that although yes, there is a positive alpha for a portfolio of vice stocks, the amount by which the alpha was positive was itself statistically insignificant.

The summary statistics of Richey’s hypothetical vice fund are as follows:

Like the market in general, this vice portfolio lost ground in fairly consistent fashion from its hypothetical inception in October 2007 into January 2009. That is the month in which the direction reversed, and its growth has generally been positive since. So far, that is true also of the market portfolio.

Three of the four types of vice stock listed above show a positive-but-insignificant relationship to the market portfolio. The one exception is the casinos/gambling industry. That yields a negative alpha.

Richey broke that down further into bull market versus bear market results. “Vice industry result during the bear market” at the beginning of the period studied, “yield more robust results” than those from the bull market thereafter. Robust in the sense of statistically significant. And this more robust result is negative.

Against the Stereotype of Inelasticity

This finding runs somewhat against stereotype. Many people believe that gamblers will gamble, smokers will smoke, rain or shine, thus (again, on this hypothesis of inelasticity) vice stocks are good places to be during a downturn, although they are ho-hum place to be when everything else is humming. Richie’s findings suggest that is exactly wrong. It would be better to “overweight a portfolio with vice stocks during ‘good’ times and alternatively underweight sin in portfolios during ‘bad’ times.”

Given how tricky the timing can be, though, he doesn’t think that a great strategy all things considered.

Although Richey doesn’t put things this way, his results might be seen as a bit of empirical support for the efficient capital markets hypothesis. After all, and contrary to the behavioral-economics reasoning behind the bet-on-vice theory, Richey’s data tend to show that te market neither over-discounted nor under-discounted the vulnerability of the vice ridden stocks. It made Goldilocks her porridge, discounting juuuust right.

Richey’s study is titled “Can Naughty be Nice for Investors” and subtitled “A Multi-Factor Examination for Vice Stocks.”