Two economists at the Division of International Finance, Board of Governors, Federal Reserve System, have written a discussion paper on sovereign debt crises. Though the paper makes no specific reference to Argentina, at this moment in history, as the long-lasting Argentine debacle seems at last to be coming to a head, the paper makes especially timely reading.

Two economists at the Division of International Finance, Board of Governors, Federal Reserve System, have written a discussion paper on sovereign debt crises. Though the paper makes no specific reference to Argentina, at this moment in history, as the long-lasting Argentine debacle seems at last to be coming to a head, the paper makes especially timely reading.

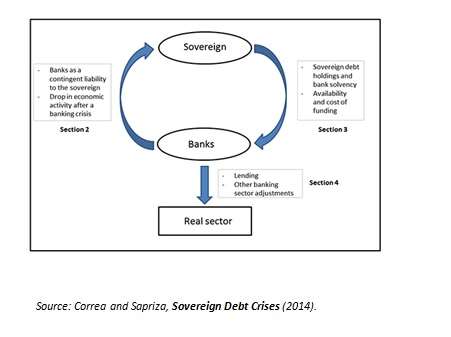

The gist of the paper, by Ricardo Correa [pictured here] and Horacio Sapriza, is that there is a tight feedback loop between sovereigns and banks, and that the real economy (“Main Street” in the usual expression) suffers from the tightness of that loop.

Breaking the loop, then, should be “an important policy priority.”

Certainly twin crises, of a country’s banking system and of its Treasury, have become quite common.

Why? The most obvious impact of a banking crisis upon a government is that governments now routinely assume safety net responsibilities in connection with their local banking systems. This comes about through obvious and appealing motives (who could be in favor of bank runs and the devastation of life’s savings they can create?). But it does have the consequence that if the banking industry is broadly in trouble, then the government’s credit will come into question as well.

Here’s the thesis in the form of a simple graphic.

Aside from safety nets or 2B2F presumptions, there is an indirect path by which bad news for the private banking sector becomes bad news for the public sector. The troubles of the former have macro-economic consequences, and these can threaten revenue collection, weakening the fiscal position of the state.

Other Side of the Loop

On the other side of the loop, there are both obvious and less obvious ways in which sovereign debt can affect banks’ solvency. The most obvious is to be found right there on the balance sheet: banks hold a lot of sovereign debt (of their own sovereign and other sovereigns) as assets, and they have to mark these assets down in the event of default or install increasingly significant hedges as a default comes to seem likely.

A somewhat less obvious channel is the impact of a sovereign debt crisis on bankers’ collateralization practices. Sovereign debt is commonly used to collateralize repos, and a bank may find its counterparties demanding increasingly large haircuts on its collateral in times of sovereign crisis.

One consideration that makes the whole feedback loop tighter than one might prefer is that baks have every incentive to arbitrage regulations. Correa and Sapriza observe that if a “bank is faced with the option of making a loan or holding a sovereign security, regulatory requirements may tip the balance toward the latter.” Empirically, banks with lower required capital levels have been found to have increased their risky sovereign holdings during the recent Eurozone sovereigns’ crisis.

Also, banks tend to hold a lot of the sovereign debt of their own country because this helps them in obtaining loans from that country’s lender of last resort. The central bankers often expect such securities as collateral.

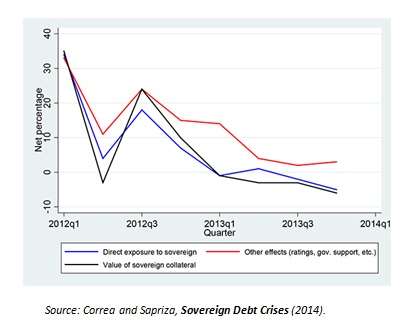

The ECB, in its euro area bank lending survey, has been asking bankers whether they believe that certain factors at the sovereign level have hurt their funding conditions.

Changing Answers Over Time

The chart above shows the changes in their answers over time. Changes in the value of sovereign collateral, the direct exposure to the sovereign, and “other effects” (the black, blue, and red lines respectively) all hurt banks, in the eyes of more than 30% of respondents, at the start of 2012. That may plausibly be regarded as the height of the Eurozone twin crisis. There was a sudden decline in the salience of these three points in the second quarter, and a return to crisis-mode answers in the third. There has been a more gradual tailing off since.

The “other effects” (the red line, which has usually in the covered period been the highest of the three) include “automatic ratings downgrades affecting your bank following a sovereign downgrade or changes in the value of the domestic government's implicit guarantee.”

Despite the waning of such concerns, the chart confirms Correa and Sapriza’s concern that the connection between the conditions of government and banking sector is tightest precisely when it shouldn’t be, increasing the fragility of both systems in crises.

What might be done to loosen the feedback loop?

Three Ideas

First, there has to be a “bank resolution regime that minimizes the cost to taxpayers from banking failures, especially of large banks.” The report suggests that the EU in particular hasn’t gone as far as it should in this direction.

Second, Correa and Sapriza say that deposit insurance schemes may need reform so they are optimally priced. An outmoded scheme can increase the riskiness of assets and thus the likelihood of a crisis.

Third, these authors want stricter adherence to the Basel Capital requirements. They note that until recently, Basel guidelines allowed “at national discretion, a lower risk weight [to be] applied to banks’ exposure to their sovereign (or central bank) of incorporation.” This practice helped tighten the feedback loop, decreasing the resilience that capital requirements are supposed to strengthen.